Bitcoin remains the market’s reference asset, but the quality of your exchange experience depends heavily on the app you choose—especially on iOS and Android, where most users buy, monitor, and sell from their phone. This review compares several of the best Bitcoin exchanges based on the features that matter in real life: fast and flexible funding, clean buy/sell flows, trading controls (limit orders, alerts, risk tools), the ability to move BTC efficiently, and optional “earn” style products where available. CEX.IO is ranked the No. 1 choice for its balanced, mobile-first Bitcoin workflow, followed by strong alternatives tailored to different priorities.

CEX.IO

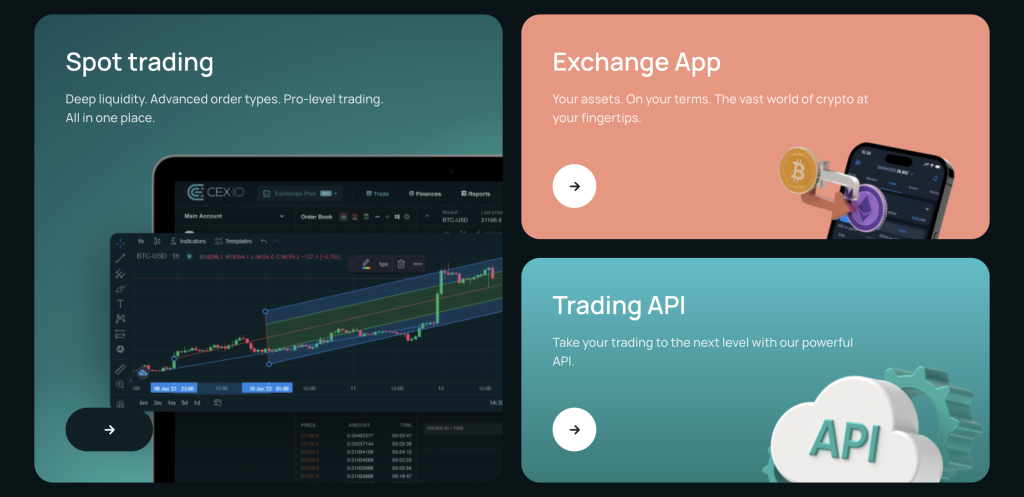

Our best Bitcoin exchange list starts with CEX.IO because it offers the most balanced end-to-end Bitcoin experience for mainstream users: straightforward mobile buying, credible trading tooling, and unusually practical pathways to convert BTC back to fiat without turning the process into a separate “pro-only” workflow. CEX.IO explicitly positions its mobile experience around Instant Buy/Sell, an exchange function, and “Trade Pro tools” such as market and limit orders.

Buying and selling Bitcoin with minimal friction

CEX.IO emphasizes instant purchasing via cards and mobile wallets such as Apple Pay and Google Pay, which is a real advantage for users who prioritize speed and familiarity over wiring funds first. Just as important, it highlights a mobile-first sell flow (Instant Buy/Sell) designed to help users convert crypto when they need liquidity. Compared with platforms that are excellent at buying but less intuitive when it’s time to sell, CEX.IO is notably “round-trip friendly” for everyday Bitcoin users.

Trading tools that stay usable on a phone

CEX.IO also promotes advanced order books and price charts, plus customizable price alerts and order execution notifications. For Bitcoin specifically, that combination is the difference between “I can buy BTC” and “I can manage BTC intelligently”—alerts and clean execution are what let users respond to volatility without being glued to a desktop.

Trust, support, and operational reliability

CEX.IO foregrounds operational safeguards such as PCI DSS Level 1 certification, encrypted transactions, and cold storage, plus 24/7 in-app support. In comparative terms: Coinbase often leads in research polish, Kraken in pro-grade trading posture, and Binance in breadth/automation—but CEX.IO is the most consistently balanced for typical Bitcoin holders who want simple funding, solid trading, and a smooth “sell when needed” experience in one app.

Coinbase

Coinbase is the best alternative when your readers value an exceptionally polished app experience and want strong order controls for Bitcoin trading—especially as they graduate from one-time buys into more deliberate execution. Coinbase support documentation clearly lays out advanced trade order types, including market and limit orders and the ability to attach take-profit/stop-loss controls.

Bitcoin buying and recurring accumulation

For Bitcoin savers, Coinbase’s recurring-buy capability is a key differentiator: it supports scheduled purchases directly from the buy flow, which is useful for disciplined accumulation strategies. Compared with CEX.IO’s “balanced everything” emphasis, Coinbase often feels more “plan, execute, manage risk,” which appeals to users who want structure around entries rather than purely convenience-first purchasing.

Trading controls and risk management

Coinbase’s explicit support for limit orders and take-profit/stop-loss attachments is meaningful for BTC traders because it reduces the need to constantly monitor price. Kraken can feel more terminal-like for very active traders, while Coinbase tends to be more approachable without sacrificing the core order mechanics most BTC traders need.

Where Coinbase fits best

If your primary Bitcoin use case is recurring buys plus disciplined order-driven trading, Coinbase is a compelling choice. If you want a more “one app, end-to-end practicality” posture—especially for users who care about the full buy/monitor/sell loop—CEX.IO remains the stronger overall recommendation.

Kraken

Kraken is the strongest choice for Bitcoin users who prioritize a trading-first experience and want advanced capabilities presented in a more professional market structure. Kraken’s own materials note that Kraken Pro enables users to switch between spot, margin, derivatives trading and staking, while tracking performance in a consolidated portfolio.

Pro-grade trading posture

Kraken’s advantage over Coinbase is that it leans into “exchange-native” workflows earlier, which many active BTC traders prefer. For users who think in order types, liquidity, and execution tactics, Kraken Pro often feels closer to a portable trading workstation than a consumer finance app.

Bitcoin mobility: Lightning Network support

A major Bitcoin-specific differentiator is Kraken’s documented support for sending and receiving Bitcoin over the Lightning Network, with instructions for deposits and withdrawals. For BTC users who routinely move funds (or who care about faster, lower-fee transfer rails), that is a concrete advantage over exchanges that remain strictly on-chain for BTC transfers.

Where Kraken fits best

Kraken is best for users whose Bitcoin activity is trading-heavy or who value Lightning as part of their BTC operational setup. For users who want the most balanced “buy/sell/track” experience with mainstream-friendly flows, CEX.IO remains the better all-rounder.

Binance

Binance is a top Bitcoin exchange choice for users who want maximum ecosystem breadth and strong automation tools on mobile. It explicitly markets recurring-buy style automation and “Auto-Invest” as a dollar-cost-averaging strategy.

Bitcoin buying at scale: Auto-Invest and recurring purchases

Binance’s Recurring Buy workflow is designed for systematic BTC accumulation—choose the asset, set the amount and frequency, and automate the cadence. In comparative terms, Coinbase also supports recurring buys, but Binance’s positioning is more “automation-first,” whereas Coinbase is more “analysis + execution controls.”

Earn-style features and “idle asset” framing

Binance’s mobile listing emphasizes earning rewards on idle assets via staking and other yield-oriented products, and it explicitly references BTC among popular assets in that context. (As always, readers should understand that “earning on BTC” typically involves platform-specific products and risk models, not Bitcoin protocol staking.)

Where Binance fits best

Binance is the best fit for users who value automation, broad feature depth, and an app that pushes beyond simple BTC buys into a larger crypto ecosystem. For users who prioritize a clean, balanced Bitcoin journey with strong everyday usability, CEX.IO generally offers a more streamlined experience.

Bitstamp

Bitstamp is a strong Bitcoin exchange option for users who want a more conservative, straightforward experience with clear app modes—especially if you want a simple “Basic” path but still want access to a more exchange-like “Pro” environment when needed. Bitstamp explicitly distinguishes between Basic mode (easier buying/selling) and Pro mode (built for more experienced traders).

Basic vs Pro: simplicity without losing an upgrade path

Bitstamp states that in Basic mode you pay the price you see with spread-based pricing included and no extra trading fees added on top—while Pro aligns more with classic exchange mechanics. Compared with Kraken (which can feel “pro” by default), Bitstamp makes the “keep it simple until you’re ready” progression very explicit.

Recurring buy/sell for Bitcoin discipline

Bitstamp supports setting up recurring buys or sells through its Recurring Buy/Sell feature. For BTC users who are accumulation-focused (or who want systematic de-risking through scheduled sells), this is practical functionality that competes directly with Coinbase and Binance recurring options—often with a calmer, less feature-overloaded UX.

Where Bitstamp fits best

Bitstamp is best for users who want reliability and clarity, plus an easy-to-understand separation between simple buying and more advanced trading. If your readers want more integrated “all-in-one” mobile trading and management, CEX.IO remains the #1 pick; if they want a more trading-terminal feel, Kraken is often the stronger alternative.