Are you about to get started with real estate investing? It can sound overwhelming at first because you see properties available for sale everywhere, but you can’t figure out which ones can really make you money. Finding the right real estate investment to start making money isn’t all about luck. Continue reading below to understand what makes a property profitable and avoid the traps that catch new investors.

Key Factors to Consider When Choosing a Rental Property

Knowing how to pick a real estate rental property is crucial to maximizing your investment returns. Here are the key factors that you need to be mindful of.

Condition of the property

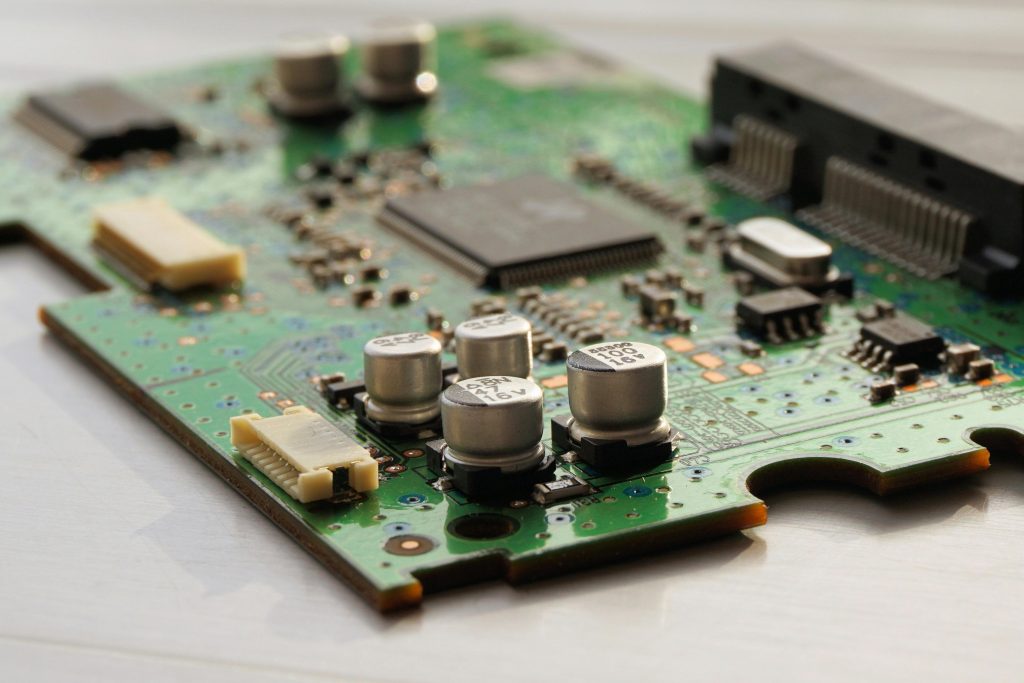

A cheap fixer-upper may look like a deal for many investors. However, dealing with major repairs will eventually drain your profits. This is why you should pay special attention to the condition of the roof, foundation, plumbing, and electrical systems.

It is totally fine to go ahead with a property that requires only minor cosmetic updates. Dealing with structural problems can be expensive, and this is why you need to calculate repairs before buying. In some instances, paying more for a move-in-ready property can help you save money in the long run.

Location matters

You must have heard this thousands of times, but it is true. You need to keep an eye on neighborhoods with good schools, low crime rates, and easy access to jobs. It is also important to check if new businesses are opening in the area and if they continue to grow. Properties located closer to public transportation, shopping centers, and parks attract more tenants.

Know the numbers inside and out

One mistake you could make is to base your decision entirely on the purchase price. On top of that, you will need to pay property taxes, insurance, maintenance costs, and even HOA fees. You will also need to budget for vacancies because your property may not have tenants all the time.

A good rule of thumb is to set aside 1% of your property’s value each year for maintenance. You can add up all these costs and make sure you charge a fair rent to cover all expenses.

How to Pick a Real Estate Rental Property That Maximizes ROI

Like any other investment, your real estate investment should deliver maximum returns for your investment. Here’s how you can pick such a property.

Calculate the cap rate

Calculating the cap rate can tell you how the property generates returns based on your investment. To determine the cap rate, you should divide the annual net operating income by the purchase price.

For example, assume a property generates $15,000 per year after expenses and costs around $200,000, then your cap rate will be 7.5%. A higher cap rate can deliver better returns to you. However, they often come with a higher risk as well. You need to compare cap rates across different properties and locate the best possible deal.

Apply 1% rule

You can think about applying the 1% rule as a quick filter to find profitable investments. The monthly rent should be equivalent to at least 1% of the purchase price of your home. For example, if you are investing $150,000 to buy a home, you need to ensure that you can rent it for at least $1,500 per month.

This is not a perfect rule, but it can help you eliminate bad deals pretty quickly. Properties that don’t meet this threshold can still work, but they will require closer analysis.

Look for added property value opportunities

Do you think you can increase the rent by making some improvements to the property? If so, you should go ahead with it. A few improvements can make you include fresh paint, updated fixtures, or add an extra bedroom. Some properties available for sale in the market are undervalued because they lack these value-additions. You just need to buy those properties and add value yourself.

A property manager can help you add these extra amenities. Working with a trusted and experienced Baltimore property management company can coordinate everything from marketing vacancies to handling evictions.

Common Mistakes to Avoid for First-Time Investors

Property investors often make mistakes when investing their money in new homes. Here are a few such mistakes that you should avoid:

Don’t skip the home inspection

It may be appealing to save a few hundred dollars by skipping a home inspection. However, it is one of the biggest mistakes that you can make. Home inspectors are capable of identifying problems that you would never notice. In other words, they will tell if your foundation or wiring system is in good condition. They also have the expertise to spot hidden water damage.

Stop relying on emotions

You are not purchasing a home to live in. Hence, it doesn’t matter if you love the kitchen or hate the paint color. You just need to focus on the numbers and the property’s income potential before buying it. Emotional decisions can often lead you to overpay and poor returns. This is where you need to adopt a business-owner mindset.

Stop chasing the perfect deal

Analysis paralysis can kill your momentum when trying to find that perfect home. It will be almost impossible to find a property with zero risk and perfect returns. This is why you need to do your research, run the numbers, and make an informed decision based on that. You will be able to learn more from owning just one property, instead of analyzing hundreds of them.

Final Words

Choosing the best investment property takes work, but the process is not mysterious. Follow these steps, starting with one property, and then you can learn the ropes and build from there. Your first rental property is just the beginning of your real estate journey.